- Asia Pacific, North America and Europe account for more than 95% of €441.47 billion global e-commerce logistics market, Transport Intelligence says

- Slowing markets in China and South Korea will see APAC giving way to North America as the biggest e-commerce logistics market in 2026, report says

- China is forecast to remain the largest e-commerce market globally and regionally until 2026 despite slowing growth

Asia Pacific, followed by North America and Europe, led the global e-commerce logistics market in 2021 as all three regions accounted for more than 95% of the market’s €441.47 billion value last year, Transport Intelligence (Ti) says in a new report.

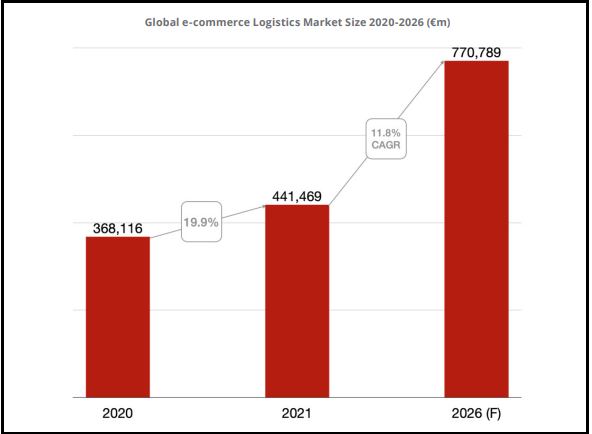

The report, “Global e-Commerce Logistics Market Forecasts 2021-2026,” noted that last year’s nominal growth eased to 19.9% year on year despite the lifting of lockdown restrictions, as supply chain problems persisted around the world.

Asia Pacific remained the biggest e-commerce logistics market worldwide in 2021, experiencing nominal growth of 16.5% and valued at €178.162 billion, Ti said. China leads APAC’s and the global e-commerce markets, and is the second-largest e-commerce logistics market worldwide.

Slowing markets in China and South Korea, however, will see APAC giving way to North America as the biggest e-commerce logistics market in 2026, with the US, Canada and Mexico registering nominal 2021-26 compound annual growth rates above the global average, Ti said.

The report cited analysts’ forecasts that Asia Pacific’s market growth will be affected by both the Chinese and South Korean markets’ 2021-26 CAGR slowing below the global average, and below the regional average of 7.1%, too.

“Their percentage of online retail sales as a percentage of total sales, at 28.0% and 24.5%, respectively, are testimony of mature markets,” Ti said, adding they will still be among the biggest e-commerce logistics markets globally due to a high number of e-shoppers.

China is forecast to be the largest e-commerce market globally and regionally until 2026 despite slowing growth, Ti said.

As of October 2021, China was estimated to have conducted over 90% of e-commerce sales through mobile devices versus 43% in the US. eMarketer forecasts that China’s online retail transactions will reach US$3.6 trillion by 2024.

However, market growth is likely going to be challenged by stringent government regulations on video content, fake traffic on live streaming sites and low network connectivity, Ti said.

Japan was No.2 in the region with a well-developed e-commerce market and sustained e-commerce growth forecast at 92.7% as of July 2021, supported by high mobile and online penetration and a high consumer preference for online transactions.

Ti cited GlobalData’s E-Commerce Analytics report that Japan’s reveals e-commerce sales would reach US$273.4 billion in 2025. Online sales as a percentage of total retail sales grew13% and are forecast to reach 22.3% of total retail sales by 2022, said Shopify.

APAC’s third biggest e-commerce logistics market is South Korea, additionally ranking among the top-10 e-commerce logistics markets worldwide both in 2021 and 2026, on an almost 99.5% penetration of households, either via PC, mobile, or another device.

The North American’s e-commerce logistics market remains the second-biggest e-commerce logistics market after APAC in 2021, experiencing a 20.6% nominal growth over 2021 to €155,359m, with Canada and Mexico growing faster than the United States.

Digital Commerce 360 says non-seasonally adjusted US Department of Commerce data shows US e-commerce growth returning to pre-pandemic levels in 2021, up 14.2% year-on-year, while digital’s share of total retail sales remained at 19.1% in 2021.

In the first five months of 2021, Canada’s retail e-commerce sales accounted for US$15.1 billion with expectations to total US$40.3 billion by 2025.

For Mexico, a study by the Mexican Association for Online Sales said the value of e-commerce retail sales totalled Mexican peso 401 billion, up 27.0% compared to 2020, with more than half of buyers being women aged 25 to 64 years old.

Overall, North America is forecast to gain market shares from Asia Pacific in 2026, becoming the biggest regional market and reaching a value of €312.11 billion.

In Europe, the UK’s e-commerce market, with online sales as a percentage of total retail sales at 26.6% as of December 2021, is expected to reel from Brexit over the next five years but remain the third-largest e-commerce logistics market globally.

The European e-commerce logistics market growth is forecast to go hand-in-hand with a decrease in cash usage and cash-on-delivery payments. In 2021, the market’s nominal growth at 24.6% is over the global average.

In the European Union, Germany, France, Spain and Italy generated more than 70.0% of the total European e-commerce logistics market, valued at €88,236m and with nominal growth of 24.6%.